The UK has completed its first year outside the European Union (EU) and its Government appears intent in pursuing its sovereignty as far as regulation is concerned. Although the official “transition period” has ended, things are far from settled for manufacturers and marketers, with new policies being drafted and existing ones amended.

GB CLP

With its exit from the EU finalized, the UK proceeded to create a Great Britain (GB) version of CLP (Classification, Labeling & Packaging of Chemicals). GB CLP is based on the UN Globally Harmonized System, as it was implemented by EU CLP on Jan. 1, 2021, but the UK has indicated that, in the future, it will reflect more changes to the GHS than to the EU CLP. The Mandatory Classification List (MCL) is now up and running, and companies placing aerosols on the GB market that are covered by CLP must use its classifications.

The UK Health & Safety Executive (HSE) will update the MCL as data on hazard classifications becomes available, but said that while parallel discussions in the EU will be taken into account, it will not guarantee the adoption of the same classifications as the EU if the evidence doesn’t support them.

For GB, the need to submit information to the European Chemical Agency (ECHA) Poison Center remains voluntary, but the British Aerosol Manufacturers’ Association (BAMA) continues to recommend that companies do so. Submitting information is mandatory in Northern Ireland and must be done by submitting information directly to the UK National Poisons Information Service (NPIS), as it has no access to information stored on the ECHA Poison Center Notification (PCN) Portal.

Last year, the European Commission brokered an agreement of the National CLP Competent Authorities (CARACAL) to exclude propellant when using a calculation method to classify aerosols for health and environmental effect. BAMA asked the HSE if this interpretation will also apply to GB CLP. The response received contains a degree of ambiguity and states, “EU guidance on the classification of propellants has no automatic applicability on UK/GB suppliers.” However, it was then added that if challenged by an enforcing authority, duty holders must ensure they can justify the decisions they made. It is understood that HSE plans to produce its regulatory guidance for GB CLP, but this is likely to take some time.

UK REACH

UK Registration, Evaluation, Authorization & Restriction of Chemicals (REACH) was created to regulate chemicals following the UK’s exit from the EU. The key principles, aims and processes of EU REACH (i.e., registration, evaluation, authorization and restriction) have been retained in UK REACH, but the two systems now operate independently from each other. UK REACH applies to chemicals manufactured, imported into and used in Great Britain, but as long as the Northern Ireland Protocol lasts, chemicals in Northern Ireland will continue to be regulated by EU REACH. UK REACH is administered by the HSE and applies to substances manufactured or imported into GB in quantities greater than one tonne per year and works in the same way as the EU version, but has four duty holders:

1. Manufacturers: Companies that produce substances in GB

2. Importers: Companies that import chemicals into GB from anywhere in the world

3. Importers under UK REACH: Those who were considered Downstream Users before EU Exit

4. Downstream Users: Companies that use chemicals in GB but are not the registered manufacturer or importer of the chemicals

Downstream Users have the obligation to use only UK REACH-registered substances in GB. Manufacturers and importers into GB must register substances they supply in quantities greater than one tonne per year. GB-based manufacturers or importers who held EU REACH registrations had a grace period to copy across their registrations from EU REACH to UK REACH. This is known as “grandfathering” and a database of over 4,000 substances has recently been published by the Dept. for Environment, Food & Rural Affairs. The advantage of following that route is that companies holding the registration have up to six years (depending on the tonnage) to provide HSE with full registration information.

Importers of finished aerosols manufactured in the EU, or companies importing EU REACH registered chemicals to fill into aerosols in GB, now fall within Group Three— Importers under UK REACH who, before EU Exit, were Downstream Users. These companies had until Oct. 27, 2021 to complete a Downstream User Import Notification, which then allowed them the same time extensions as for the previous two categories.

Chemicals that are neither in the grandfather list nor subject to the above Notification must be fully registered. On the positive side, the UK has developed an IT system to further help companies using chemicals to comply with REACH chemical regulations and to support the submission of dossiers and information to the HSE. SPRAY

From all of us at the Household & Commercial Products Association (HCPA), we wish SPRAY readers a happy and healthy New Year. Here’s hoping the challenges we’ve faced over the last two years are behind us.

Industry faced a unique set of challenges in 2021. While experiencing a global pandemic, companies had to navigate inflation, workforce shortages and significant supply chain disruptions.

This year wasn’t the first time the aerosol industry has faced challenges. To determine the impacts of various challenges, the industry has turned to the Aerosol Pressurized Products Survey, which provides robust and accurate data about the unit production of aerosol products, valves and containers in the U.S. The resulting report helps aerosol companies gauge their overall growth in comparison to the industry, identify potential opportunities within product categories and reassess their sales strategy, production planning and future investments. The data is also used to communicate with legislators, regulators and other key stakeholders about the economic impact of the aerosol industry.

This report is essential to analyze the condition of the aerosol industry. Unfortunately, participation by aerosol fillers was low this past year due to competing priorities and resource constraints caused by the COVID-19 pandemic. For this reason, we did not have sufficient data to publish a Production Data Report.

We know from other sources that some aerosol product categories—such as cleaning and disinfectant products—were very successful, while others, such as personal care products, lagged behind. However, we do not know this information to the level of specificity that the Survey typically provides. Most significantly, this lack of data prohibits us from recognizing the contributions the aerosol industry made to helping consumers and workers keep their homes and workplaces safe from COVID-19, since many cleaning and disinfectant products use the aerosol delivery form.

The Aerosol Pressurized Products Survey is the only tool that can be used to measure the impacts of the aerosol industry. This is especially important when legislators and regulators ask how big the industry is and the significance of an issue. We always point to our Production Data Report as the answer, but that won’t be possible for production levels in 2020.

Participation by aerosol fillers in this year’s Survey is critical so we can better understand the impacts of 2021 and prepare for 2022. Increased participation improves the accuracy of the results and makes it easier for the Aerosol Survey Committee—which is composed of volunteers from valve, container and propellant companies—to estimate the remaining totals and generate the final results. As we experienced last year, if there are too few participants, the Aerosol Survey Committee cannot make its estimates.

Without this data, the aerosol industry cannot explain how certain laws and regulations impact production and the economy. It also hurts the industry’s ability to identify year-over-year changes in the market, as well as determine how current market influences and demand impact specific product categories.

One of the common questions the Aerosol Survey Committee receives is how confidential information is protected. HCPA contracts a third-party survey firm—Association Research, Inc. (ARI)—to conduct the survey and collect the results. Using ARI ensures that everyone’s information remains confidential. Only the aggregate information is shared with HCPA and the Aerosol Survey Committee. Individual data is never shared.

While the Aerosol Survey Committee makes every effort to get each and every aerosol company to participate, there are still some companies who don’t respond to the survey. ARI identifies the non-responding companies and the Survey Committee uses their sales data and market knowledge to estimate the missing production for each product category. For most product categories, estimates are based on valve sales. However, when valve sales cannot be used, container sales data is used. These estimates are provided directly to ARI to ensure confidentiality.

ARI also protects confidentiality of respondents by withholding subcategory data from the Survey Committee if there are too few respondents or if a single manufacturer reports a majority of the market. Again, no individual company—whether they are an aerosol filler, valve or container supplier—is ever singled out or specifically named.

The Aerosol Pressurized Products Survey is for the aerosol industry, by the aerosol industry. It cannot be done without you.

HCPA will host a free webinar about the Aerosol Pressurized Products Survey on Jan. 13. Check back at spraytm.com for further details.

For more information or if you have any questions, please contact me at ngeorges@thehcpa.org. SPRAY

Welcome to the New Year, which promises to again be busy for Air Quality regulations. Numerous entities will be working on developing or updating volatile organic compound (VOC) regulations.

CARB

The California Air Resources Board (CARB) will continue to finalize its Consumer Products amendments that were adopted last March. If you manufacturer air fresheners, hair sprays, dry shampoos or personal fragrances, make sure your products are compliant with the VOC limits taking effect on Jan. 1, 2023. Do not wait for regulations to be final to reformulate. Limits and effective dates will not change. Remember to check out the Innovative Product Exemption (IPE) provisions, which may assist you in reformulating.

SIP

The State Implementation Plan (SIP) will be developed in 2022 and Consumer Products are the number one emission sources in California. Thus, Consumer Products will likely be targeted for further VOC reductions in the next few years.

Expect CARB to start some type of activity in 2022, most likely surveys of product categories that it believes have potential to reduce VOCs. The good news is that CARB stated it will likely use Reactivity, or as it calls it “Ozone Formation Potential” to try and regulate future product categories.

The SIP will likely be finalized mid-to-late Summer of 2022.

CARB Date Code

This is my friendly annual reminder, urging you to make sure you are up-to-date on Product Dating/Date Coding. When I met with CARB in September of 2021, it stated this will be an area it will target in 2022.

Remember, date code information needs to be reported to CARB every year by your company if you do not use CARB’s standard date coding. California Section 94512 (b) product dating specifically requires that all consumer products sold into the State display the day, month and year the product was manufactured or a code indicating the date. CARB has been increasing its activity—investigating and levying fines for non-compliance of this section.

The date or date-code information shall be located on the container or inside the cover/cap so that it is readily observable or obtainable (by simply removing the cap/cover) without irreversibly disassembling any part of the container or packaging. Information may be displayed on the bottom of a container as long as it is clearly legible without removing any product packaging.

CARB’s standard code has to be represented separately from other codes on the product container so that it is easily recognizable. The format is: YY DDD = Year Year Day Day Day. A manufacturer who uses this standard CARB code to indicate the date of manufacture does not have to report this code.

Failure to register a date code is subject to fines, which seem to increase every year. Your date code explanation needs to be submitted by email (cpenforcement@arb.ca.gov) to CARB Enforcement on an annual basis, on or before Jan. 31 of each year.

Other States

New York State’s updated VOC Consumer Products regulation became effective on Jan. 1, 2022. Make sure you are only shipping compliant products into New York State. Products produced before this date have an unlimited sell-through.

Michigan and Ohio are likely to update their Consumer Products VOC regulations this year; Michigan has already started. Industry is working with these States in an effort to make consistent regulation throughout the region.

Current thinking is to use Ozone Transport Commission (OTC) model Rule 4. This will make these States consistent with several Northeastern States, Colorado and Utah.

It is possible that Oregon and Washington State may develop VOC regulations on Consumer Products. Again, our goal would be to make the regulations consistent.

Canada & Mexico

Canada may post the final version of its Consumer Products VOC regulation early in 2022. Canada has stated there will be a two-year phase-in effective date, meaning the regulation will likely be effective as of Jan. 1, 2024. In addition, we believe there will be an unlimited sell-through period for product produced before the effective date.

Canada has said it has updated the regulation but we have not seen any of the changes. This should be very interesting!

There is no update from Mexico but we should find out some information later this year. SPRAY

Happy New Year, everyone. In the December 2021 issue of SPRAY, I discussed the most common formula factors that affect spray package corrosion. In this issue, we’ll complete the discussion with the most common package factors that affect spray package corrosion:

1. Type of package (e.g., aerosol containers and bag-on-valve)

2. Type of internal package surface treatment (e.g., packages with or without internal coatings or polymer films)

3. Microenvironments inside a package

1) Type of package

Currently, spray packaging consists of traditional aerosol containers and aerosol containers with internal bags. No single type of spray package is more corrosion-resistant than another. In other words, there’s no type of spray package that will resist corrosion by all types of formulas.

Internal bags are typically either blow molded bags or laminate metal foils formed into bags. Laminated foil bags are attached to aerosol valves.

Traditional aerosol containers are currently fabricated from either steel or aluminum alloys.

2) Package surface treatment

The treatment of spray package internal surfaces includes very thin tin metal coatings, microscopic coatings of chromium and various polymer coatings on steel containers. Aluminum container internal surfaces are coated with thin polymer coatings. Laminate films for internal bags are aluminum foil with a laminated film bonded to the foil. Laminate films can be either a single layer or a bi-layer of two different polymers. Both steel and aluminum aerosol valves are coated with a variety of polymer coatings or polymer laminate films.

3) Corrosion microenvironments

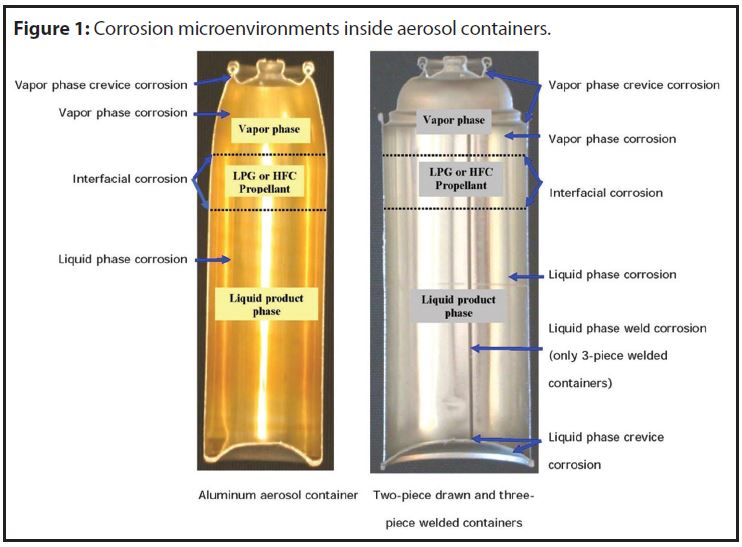

Figure 1 provides a photograph that identifies the various corrosion microenvironments inside aluminum (left) and steel (right) aerosol containers. The steel container in Figure 1 is constructed by seaming the top and the bottom to the body. However, steel aerosol containers today also include those constructed by seaming either only the top or only the bottom to the body.

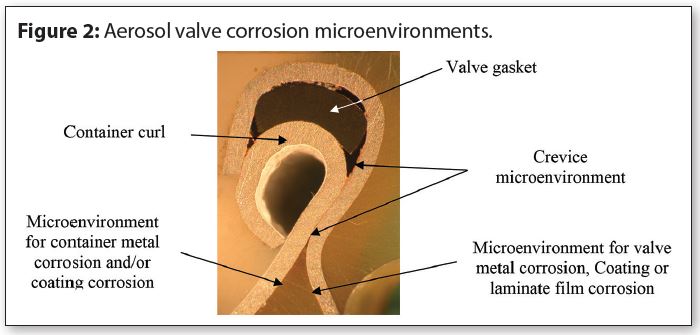

Simultaneous corrosion in more than one microenvironment does occur. In most situations, there is also a high probability of corrosion in more than one microenvironment. A phenomenon known as chasing corrosion around the container occurs when a corrosion inhibitor stops corrosion in a specific microenvironment and subsequently starts in another microenvironment. Figure 2 provides a photograph that illustrates the various corrosion microenvironments for aerosol valves crimped (clenched) to the top curl of an aerosol container. The gasket above the curl seals the container to the aerosol valve. A cut gasket is shown in

Figure 2, but other types of gaskets are also used to seal valves to containers.

Notice in Figure 2 that a corrosion microenvironment is formed in the crimp crevice between the valve and the container curl. The cavity formed between the crimp and the gasket is also a macroenvironment. Other microenvironments occur in the area below the curl-valve crimp in Figure 3 whenever there is metal and/or coating/laminate film corrosion.

Figure 3 provides a photograph of the various corrosion microenvironments inside bag-on-valve (BOV) packages that are inserted inside aerosol containers. Microenvironments form when either the laminate film or the metal foil corrodes.

Summary

The more common formula factors and package factors that cause or contribute to spray package corrosion were identified in Part 1 and Part 2 of this column. Synergy between these two factors adds to the complexity of spray package corrosion. This complexity explains why spray package corrosion is typically difficult to predict. Consequently, corrosion testing is needed to determine if a given formula with specific ingredients will either cause or contribute to spray package components.

Thanks for your interest and I’ll see you in February. Contact me at 608-831-2076; rustdr@pairodocspro.com; or from one of our two websites pairodocspro.com

and aristartec.com. SPRAY

The Globally Harmonized System of Classification & Labeling of Chemicals (GHS) was developed by the United Nations (UN) to address classification of chemicals by hazard type and propose harmonized hazard communication elements, including labels and safety data sheets (SDS). Despite its name, the GHS is neither completely “global” nor “harmonized” due to the varying implementation approaches enacted by governments around the world. However, GHS does provide a basis for harmonization of rules and regulations on chemicals at a national and international level, which is an important factor in trade facilitation.

This column discusses the latest edition of UN GHS, as well as recent implementation steps taken by some key jurisdictions around the world. While some countries move to implement their first iteration of GHS, others are adopting newer revisions of the system to provide increased worker health, safety benefits and protection.

UN releases 9th Revision of GHS

On Dec. 11, 2020, the Committee of Experts on the Transport of Dangerous Goods & on the Globally Harmonized System of Classification & Labeling of Chemicals adopted a set of amendments to the 8th revised edition of the GHS. The amendments include updates to Chapter 2.1 (Explosives) to better address explosion hazards when products are not in their transport configuration. Other changes include the revision of decision logics, changes to the classification and labeling summary tables in Annex 1, as well as the revision and further rationalization of precautionary statements. References to the Organization for Economic Cooperation & Development (OECD) test guidelines for the testing of chemicals in Annex 9 and Annex 10 were also updated.

The 9th revised edition of GHS, which incorporates these amendments, is currently available for consultation purposes in English and French on the UN Economic Commission for Europe (UNECE) website. The other four official UN languages (Arabic, Chinese, Russian and Spanish) are expected to be posted as they become available.

Chile implements GHS & chemical registration requirements

On Feb. 9, 2021, Chile’s Ministry of Health published Decree 57 of 2019, Regulation on Classification, Labeling &

Notification of Hazardous Chemicals & Mixtures. This new decree marks the formal implementation of GHS in Chile as well as a new chemical reporting system, each with established implementation timelines. Although the decree references the UN Purple Book (a GHS guidance document), it is not based on a specific version of GHS. Product types that are excluded from GHS provisions include hazardous waste, medical devices, pharmaceutical products, food additives and animal feed. The Ministry of Health plans to publish an official list of chemical classifications for substances that will specify the hazard classes and categories. In the future, these official substance classifications will need to be taken into consideration when assessing the hazards of products sold in Chile.

Manufacturers and importers will be obligated to submit a notification to the Chilean government when quantities of a hazardous substance meet or exceed one ton per year.

The deadlines for implementation of GHS in Chile are as follows:

• Substances for industrial use: Feb. 9, 2022

• Substances for non-industrial use: Feb. 9, 2023

• Mixtures for industrial use: Feb. 9, 2025

• Mixtures for non-industrial use: Feb. 9, 2027

Deadlines for registration will come into effect two years after the GHS implementation dates specified above. For example, registration of substances for industrial use will be required by Feb. 9, 2024. Chemical registration is not required for active ingredients in pesticides for agriculture, health and home use.

Columbia moves forward with workplace GHS implementation

On April 7, 2021, Columbia’s Ministry

of Labor published Resolution 0773/2021, defining the actions that employers must take to implement GHS in the workplace. Implementation of the GHS 6th revised edition was approved in 2018 by Decree 1496/2018 and will proceed based on the timelines established under Resolution 0773/2021.

The transition period for implementation depends on the type of product and the deadlines are as follows:

• Pure chemical substances and diluted solutions: April 7, 2023

• Mixtures: April 7, 2024

Labels and SDS must be in the Spanish language and classified in accordance with Revision 6 of GHS. Employers are required to review the data that SDS and label information is based on every five years, at minimum. The SDS must also include a local or toll-free 24/7 emergency phone number.

According to Resolution 0773/2021, label sizes for containers should align with EU Regulation (EC) No 1272/2008 and be proportional to the size of the container. Components contributing to acute toxicity, skin corrosion or severe eye damage, reproductive toxicity, mutagenicity, carcinogenicity, specific target organ toxicity or skin/respiratory sensitization must be identified on the label.

Australia moves to GHS Revision 7

On Jan. 1, 2021, the two-year transition period for updating from the 3rd edition to the

7th edition of GHS in Australia began. By 2023, GHS Revision 7 must be used to prepare SDS and labels of hazardous chemicals in Australia.

The key changes involve product classification updates:

• “Flammable aerosols” hazard class becomes “Aerosols” and a new hazard category for non-flammable aerosols is added (Category 3)

• A new physical hazard is being introduced for Desensitized Explosives: Categories 1–4

• Flammable Gas 1 will be divided into Category 1A and 1B and three new flammable gas categories are added:

■ Pyrophoric gas

■ Chemically unstable gas A

■ Chemically unstable gas B

• All Category 2 Eye irritants, including the formerly exempt Category 2B, will now fall under the definition of “hazardous chemical” under the model Work Health & Safety (WHS) laws

There are no major changes to the format of the SDS itself.

New Zealand moves to GHS Revision 7

On April 30, 2021, New Zealand implemented the 7th revised edition of GHS as its official workplace hazard classification system. SDS and labels for new hazardous materials must now be authored according to GHS Revision 7. There is a four-year transition period to update existing labels and SDS to comply with the new classification requirements; this ends on April 30, 2025.

classification system. SDS and labels for new hazardous materials must now be authored according to GHS Revision 7. There is a four-year transition period to update existing labels and SDS to comply with the new classification requirements; this ends on April 30, 2025.

As with the changes for Australia, the new requirements in New Zealand are primarily concerned with the hazard classifications. Revision 7 of the Purple Book applies for classification purposes, except for building blocks that are not adopted in New Zealand, such as the Acute Toxicity 5 and Skin Irritant 3 categories.

There are some differences in the classification cut-offs for New Zealand in comparison to the Purple Book—specifically, the deviations that affect the Skin & Respiratory Sensitizer, Specific Target Organ Toxicant, Carcinogen and Reproductive Toxicant classifications.

Previously, New Zealand managed hazardous substances under several different pieces of legislation. The key regulation was the Hazardous Substances & New Organisms (HSNO) Act, which set criteria that designate a substance as hazardous and assign it an HSNO hazard classification number. The HSNO number determines the nature and level of its conditions of use.

Companies were formerly required to use HSNO classifications on SDS and labels and could additionally choose to include the GHS format. Now, for the first time, the HNSO numbers have been converted to equivalent GHS classifications. All Pre-2021 HSNO classification codes have been revoked, except hazards to the terrestrial environment for agrichemicals, which do not have a GHS equivalent and comprise the following categories:

• Hazardous to soil organisms (9.2A, 9.2B, 9.2C, 9.2D)

• Hazardous to terrestrial vertebrates (9.3A, 9.3B, 9.3C)

• Hazardous to terrestrial invertebrates (9.4A, 9.4B, 9.4C)

• Designed for biocidal action (9.1D)

if you sell hazardous products in Chile, Columbia, Australia or New Zealand, we suggest taking note of the implementation deadlines for the new regulations in each country. This way, you can plan ahead to prepare for any new obligations and ensure that your documentation remains compliant. SPRAY

CARB

California Air Resources Board (CARB) staff continues to work on finalizing its last rule development. New volatile organic compound (VOC) limits are in place for Hair Spray, Dry Shampoo, Personnel Fragrance and Aerosol Air Freshener. Even though the rule development has not gone through its final stages, these new VOC limits become effective as of Jan. 1, 2023, which is only 13 months from now. Thus, if your company sells these products, you should be working on reformulating products to meet these stringent new VOC limits. As always, there is a three-year sell-through for all product produced before Jan. 1, 2023.

2022 State Implementation Plan

Just when you thought CARB was done with Consumer Products regulation for a while, more crops up. On Oct. 19, 2021, CARB staff held a Public Workshop on the State of California’s new State Implementation Plan (SIP)—future regulatory measures to attain its 70 parts per billion (ppb) 8-hour ozone requirement. This means the State of California is planning for more regulations to come into compliance with Federal mandates for clean air. This plan will require actions (regulations) to be developed by Air Districts, CARB and the U.S. Environmental Protection Agency (EPA) to meet the

70 (ppb) ozone standard.

Consumer Products will be just one area where further regulation will be required. CARB will be requiring more stringent regulations on mobile source control (automobiles and trucks). These measures will include zero emissions and near zero emission requirements. CARB will also petition action on primarily Federally regulated sources (ships and rail cars).

However, CARB will be looking to Consumer Products for more emission reductions. As reported last month, Ravi Ramalingam, Chief of the Consumer Product Branch for CARB, presented a glimpse of this work to be done at the Western Aerosol Information Bureau (WAIB) meeting that was held in September. At the Oct. 19 workshop, CARB stated, “VOC emissions from Consumer Products now exceed those from any other emission source category.” This means we have a big target on our (Consumer Products) back.

CARB will be seeking further emission reductions from Consumer Products to support ozone attainment in the South Coast and elsewhere in California. We have known for years that Consumer Products in the South Coast Air Quality Management District (SCAQMD) have been significant. CARB plans to conduct additional targeted product surveys on Consumer Product categories to guide its rule development.

CARB plans to ensure these further emission reductions with state-of-science measures. Does this mean Reactivity? CARB further stated, “Staff will consider opportunities for ozone formation reductions from already regulated product categories as well as previously unregulated categories.” Here we go again.

The good news is CARB staff also stated, “Given the maturity of the Consumer Products Program and success in reducing the VOC content of well over 100 categories of products, securing necessary further emission reductions from already regulated categories may be challenging.” CARB then said it will also be challenging to regulate previously unregulated categories, as well. This is all great news; CARB stated lack reformulation options, low VOC content, high cost of reformulation or poor cost effectiveness as reasons to limit further Consumer Product regulations. I cannot agree more with these reasons.

To date, CARB has not stated any required amount of VOC reduction for Consumer Products, but has stated that issues such as Greenhouse Gas (GHG) emissions will be reduced, if possible.

CARB staff also stated that VOC limits and reactivity-based limits will be considered—again, this great news.

We need to monitor this issue very closely over the next 6–7 months to make sure industry is not required to address a large VOC reduction that cannot be met. More to come!

New York

Remember the New York State Consumer Products VOC regulation becomes effective as of Jan. 1, 2022. The VOC limits are very similar, if not exact, to other OTC States such as Connecticut, Delaware, Maryland, Rhode Island, New Hampshire, Colorado and Utah.

Any product produced before Jan. 1, 2022 has an unlimited sell-through in New York.

Wishing everyone Happy Holidays! SPRAY

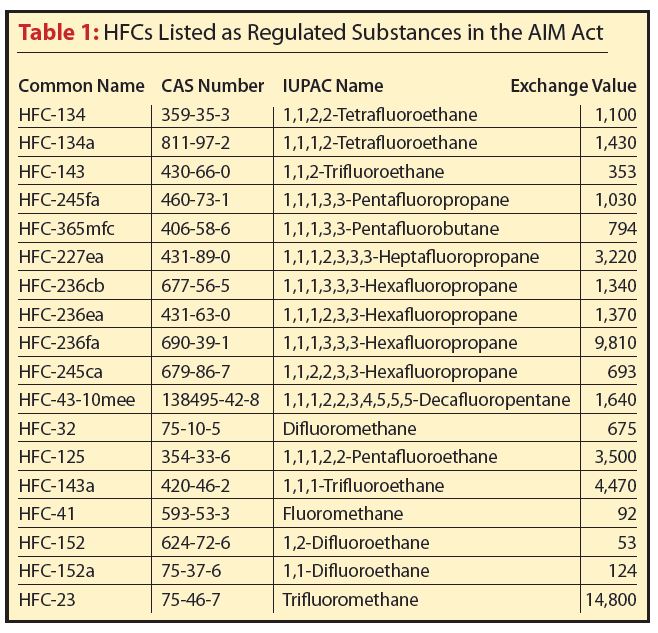

On Sept. 23, 2021, Michael Reagan, Administrator of the U.S. Environmental Protection Agency (EPA), signed the Phasedown of Hydrofluorocarbons: Establishing the Allowance Allocation & Trading Program Under the American Innovation & Manufacturing Acti final rule, which established a program to cap and phase down the production and consumption of hydrofluorocarbons (HFCs) for 2022 and 2023, as well as set the baseline levels from which reductions will be made. The EPA uses an allowance as the unit of measure that controls the production and consumption of HFCs.

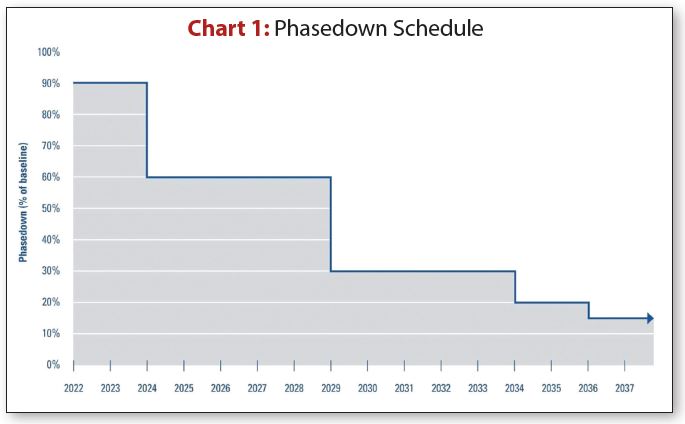

Following Administrator Reagan’s announcement, the EPA issued Phasedown of Hydrofluorocarbons: Notice of 2022 Allowance Allocations for Production & Consumption of Regulated Substances Under the American Innovation & Manufacturing Act of 2020ii, which set the production and consumption HFC allowances for 2022 at 90% of the baseline established in the final rule.

As directed by Congressiii, the EPA must phase down the consumption and production of HFCs by 85% below baseline levels by 2036. The EPA set these baselines at 385.55 million metric tons of exchange value equivalent (MMTEVe)iv for production and 303.89 MMTEVe for consumption. The American Innovation & Manufacturing (AIM) Act specifically lists 18 HFCs that must be addressed (see Table 1). While the majority of the phasedowns are directed at refrigerants and air conditioning, the list also includes HFC-134a and HFC-152a, both of which are of interest to the aerosol propellant industry. This directive goes further than current State regulations for HFCs, which were based on the EPA’s rescinded Significant New Alternatives Policy (SNAP) Program Rules 20 and 21, and focused on restricting the use of high global warming potential (GWP) HFCs (those greater than 150v).

While the EPA needs to reduce the production and consumption of HFCs by 85% below baseline levels by 2036, that won’t happen instantaneously, which is why we use the term “phasedown.” Chart 1vi shows the schedule for when reductions are expected to occur compared to baseline levels.

Readers who are not familiar with the AIM Act may be wondering what the “Exchange Value” column represents. Rather than treat all HFCs as the same and phase down their total mass, the EPA is phasing down their emissions of equivalent metric tons of carbon dioxide (CO2). The “Exchange Value” is equivalent to the 100-year GWP of the chemical as found in the AR4v, which is effectively the tonnage multiplied by the exchange value. In short, the production and consumption of higher GWP HFCs will require more allocation than HFCs with a lower GWP.

There are a few important things to be aware of when looking at how the EPA gave out HFCs allocations for 2022. Congress directed the EPA to give mandatory allocations to six applications: metered dose inhalers; defense sprays; structural composite performed polyurethane foam for marine use and trailer use; etching of semiconductor material or wafers and the cleaning of chemical vapor deposition chambers within the semiconductor manufacturing sector; mission-critical military end-uses; and on-board aerospace fire suppression.

Beyond these six applications, allowances went to companies that manufactured or imported bulk HFCs. Companies that don’t manufacture or import HFCs, but rather purchase them from channels of distribution for various applications, did not receive allocations. Therefore, aerosol companies that don’t manufacture or import bulk HFCs and don’t manufacture metered dose inhalers or defense sprays don’t need to worry about not receiving allocations for 2022.

However, there are concerns from both industry and the non-governmental organization (NGO) community regarding how the EPA is allocating allowances related to imports since allowances are required only for bulk HFCs and not products containing HFCs. Not including the import of these products could potentially undermine the environmental benefits that the AIM Act is expected to provide.

The Household & Commercial Products Association (HCPA) and National Aerosol Association (NAA) are working together to provide the EPA with information that will assist it in its next allocation rulemaking. The EPA needs to conduct a subsequent rulemaking to govern the allocations for 2024 and beyond; 2024 is a critical year because it’s when the cap on the production and consumption of HFCs will drop from 90% of the baseline to 60%. That significant drop will surely be felt by domestic manufacturers, and for the benefits of the AIM Act to be fully realized, imported materials and finished products that contain HFCs must be included in the phasedown.

This article provides a high-level overview of the AIM Act and its impacts, but if you have specific questions or would like to get involved with our activity related to HFCs, please contact me at ngeorges@thehcpa.org. SPRAY

i The final rule is available here.

ii The final rule is available here.

iii The AIM Act is available here.

iv MMTEVe is numerically equivalent to one million metric ton of CO2 equivalent

v According to the Intergovernmental Panel of Climate Change (IPCC) Fourth Assessment Report (AR4)

vi Available here.

Package corrosion is a complex interaction between a large number of formula and package factors. It has been my experience that there are at least 16 known corrosion-contributing and/or corrosion-causing factors for spray packaging. These factors can be grouped into formula and package subcategories as follows:

1. Formula factors

Ingredients

• Propellant type

• Fragrances

• Formula water or contaminant-water

• Formula ingredient and contaminant-water concentrations

• Corrosion inhibitor concentrations that are above or below the effective concentration range

• Formulas containing carboxylic acids and unsaturated molecules

• Surfactants/Detergents

• Fragrances

• Perception-enhancing ingredients

Formula physical form

• Single phase or multiple phases inside the package

• Emulsion types—water-in-oil (oil out), oil-in-water (water out) and microemulsions

2. Package factors

• Type of package (e.g. aerosol containers and bag-on-valve)

• Type of internal package surface treatment (e.g. packages with or without internal coatings or polymer films)

• Internal package coating type and coating micro-morphology

• Microenvironments inside a package

• Internal package metallurgy and geometry (e.g. welds, double seams, valve clench)

Synergy between two or more of these different formula and/or packaging factors could produce significantly more aggressive corrosion than the corrosion by only an individual factor. In other words, a combination of two or more formula and/or package factors could lead to aggressive, unexpected corrosion with very short package service lifetimes.

The large number of factors, along with the possibility of synergy, shows the complexity of spray package corrosion. I’m going to discuss the top five formula factors in this month’s column and the package factors in the next issue.

Water

Potential hydrogen (pH) is a measure of hydrogen ion concentration in water. For example, water having neutral pH of 7 has 0.0000007 moles/liter hydrogen ions and a pH of 2 has 0.02 moles/liter hydrogen ions. In other words, lower pH numbers have more hydrogen ions in the water and are potentially more corrosive. Metal valence electrons can be easily removed from surface metal atoms by hydrogen ions because they are electrochemically active, as shown in Equation 1:

2H+ + 2e- (from package metal) → H2 (gas)

Water could be in a formula either as an ingredient or as a

contaminant. Water dissociates into hydrogen ions and hydroxyl

ions, as shown in Equation 2:

2H2O + 2e- (from package metal) → H2 (gas) + 2OH

The electrons in Equation 1 and Equation 2 are supplied by the package’s surface metal atoms.

Water molecules are small and easily absorb into the holes and empty channels in polymer coatings and laminate films; they then continue to diffuse through the coatings and the films. Diffusion often leads to metal and/or polymer corrosion when water accumulates on the metal substrate in microscopic cavities underneath the coating.

Water is also a solvent for other formula ingredients and often brings them to the metal surface under the polymer coating or laminate film. The chemical composition of the liquid water-plus-formula-ingredients is typically different from your bulk formula composition.

Consequently, polymer corrosion occurs with coated spray packages and metal corrosion occurs with both coated and uncoated packages.

Propellants

Water is slightly soluble in HFC152A propellant and thus this propellant can bring contaminant-water into anhydrous formulas. Contaminant-water might or might not contribute to or cause spray package corrosion, depending on its concentration in the formula.

DME propellant is a strong solvent for most spray package coatings. Hence, there is a higher probability that DME could cause internal package coating corrosion that might or might not lead to corrosion of the metal under the coating.

Carbon dioxide propellant dissolves in water to form carbonic acid. Carbonic acid dissociates into hydrogen ions and bicarbonate ions, as shown in Equation 3:

H2CO3 (carbonic acid) → HCO3- (bicarbonate ion) + H+

The hydrogen ion in Equation 3 is electrochemically active (see Equation 2) and the bicarbonate ion in Equation 3 is also electrochemically active, as shown in Equation 4:

2HCO3- (bicarbonate ion) + 2e- (from the package metal) → H2 + 2CO3=

A corrosion inhibitor is most likely, but not always, needed when these three types of propellants are used.

Not all propellants contribute to or cause spray package corrosion. For example, both nitrogen and liquefied petroleum gas (LPG) (hydrocarbon propellants) are not electrochemically active and LPGs are typically weak solvents. Hence, nitrogen and LPG propellants do not typically contribute to or cause spray package corrosion.

Formulas containing carboxylic acids & molecules with unsaturated chemical bonds

Carboxylic acids in a formula can dissociate to produce corrosive hydrogen ions, depending on the formula/contaminant-water pH. However, in some instances, carboxylic acid salts, such as sodium benzoate, adsorb onto the package metal surface and inhibit corrosion instead of contributing to or causing corrosion.

Molecules with unsaturated chemical bonds could become saturated (and more stable) in some instances, by removing metal valence electrons. However, the unsaturated bonds are typically not electronegative enough to completely remove valance electrons from metals. Thus, in some instances, unsaturated bonds adsorb on the metal surface and share the metal’s valence electrons instead of removing them. This situation sometimes produces corrosion inhibition.

Surfactants/Detergents

Surfactants make metal surfaces more or less susceptible to water adsorption. Consequently, surfactants could contribute to metal corrosion when they wet the metal surface (hydrophilic). Hydrophylic surfactants also enhance absorption and diffusion through polymer coatings and films.

A hydrophobic surfactant repels water, thus decreasing absorption and diffusion through coatings and laminates—thus either impeding or inhibiting corrosion.

Some surfactants, such as sodium lauryl sulfate, cause corrosion in a wide variety of environments, such as consumer packaged goods formulas.

Fragrances

A few fragrances have been shown to contribute to or cause spray package corrosion, such as those containing vanilla. However, most fragrances act to some degree as corrosion inhibitors, although it is unknown why and when this happens. I hypothesize that certain fragrances act as corrosion inhibitors when one or more of their components with unsaturated bonds attach themselves to the metal surface and share the metal’s electrons with it instead of removing these electrons. There are a few technical publications concerning corrosion inhibition by natural chemicals, such as tannins.

Ultimately, corrosion testing is needed to determine if a given formula and/or specific ingredients will either cause corrosion of the chosen spray package components or if they will inhibit corrosion.

Thanks for your interest and I’ll see you in December. Contact me at 608-831-2076, rustdr@pairodocspro.com or from one of our two websites: pairodocspro.com or aristartec.com. SPRAY

What if there was a place you could go, whenever and wherever you wanted, to learn from trusted industry experts on all facets of the aerosol and pressurized packaging industry?

What if instead of having to set up 5–6 different day-long meetings once or twice a year for new employees to educate them on aerosols and pressurized packaging, you could simply send them a website link and they could learn both individually and immediately?

What if you joined a personal care, household or automotive brand and wanted to understand the possibilities of developing and formulating aerosol or pressurized packaging?

Thanks to the collaboration of all U.S.-based regional and national aerosol associations, this dream is now a reality. Introducing the new Mist:Understood Aerosol & Pressurized Packaging Virtual Classroom.

How it came about

At the onset of the COVID-19 pandemic, the Western Aerosol Information Bureau (WAIB), like many other organizations, was contemplating how it could serve its constituency and the industry overall in the absence of in-person events. WAIB leadership had observed a growing trend in virtual learning as people had more time on their hands while staying home and were looking for options for continued learning and development.

“When the idea of creating an online aerosol educational tool was first suggested, I became inspired by my own positive online classroom experience at Google Digital Garage,” said Mary Metzner, WAIB Administrator.

Given the complexity and technical knowhow surrounding aerosols and pressurized packaging, the development team researched resources available to the aerosol and pressurized packaging industry. What it found was a splintered, decentralized offering of information, with varying degrees of credibility; therefore, the idea of a central, credible online source for education seemed like a “no-brainer.”

While performing a survey of current information on aerosols and pressurized packaging available online, the team found there were limited sources of credible, non-biased, easy- to-understand information in one place.

As a WAIB Board Member and an organizer of the initiative, I and my fellow researchers realized that sites such as Wikipedia are open to public editing; some sites have information that is so technical it would be beyond any beginner to understand while other sites are very sales-driven.

Given the potential of the idea, WAIB members felt this was a perfect opportunity for cross-organization collaboration. It engaged the Consumer Aerosol Product Council (CAPCO), National Aerosol Association (NAA), Eastern Aerosol Association (EAA), Midwest Aerosol Association (MAA) and Southern Aerosol Technical Association (SATA) for support.

The aerosol and pressurized packaging industry is a tight-knit community built on relationships and mutual support, and this initiative was no different. It was really special to see all the associations come together (albeit virtually) to support an idea that started on a PowerPoint slide and truly see its potential. The industry partners who provided the content were no different, and a huge kudos to them for collaborating amongst themselves to divide up topics to provide the best possible experience for users of the site.

“The NAA is very grateful for the hard work and cooperation that has accomplished the development of an online Aerosol 101 Class video,” noted Joe Bowen, NAA President.

“This represents a very important, new, on-demand tool for the aerosol industry to provide education to new team members at our companies.”

The Virtual Classroom was developed to be agnostic of suppliers, thus able to interact with any systems or any products in the same category, to avoid having the classes seem like a sales pitch. Classes are limited to 20 minutes or fewer to stay cognizant of attention spans and time constraints, and content is structured to meet the needs of a range of students—from beginners to intermediate to advanced. With more than 200 people enrolled after its launch in September, the Classroom is off to a strong start.

The Virtual Classroom is suitable for those wanting to learn more about the industry. New aerosol industry employees, product developers working on aerosol or pressurized packaging developments, consumers looking to understand more about recyclability and sustainability—the audience possibilities are endless.

The site allows each user to create their own profile where they can keep track of progress. Additionally, every participant who successfully completes a free course will receive a digital certificate of completion that can be easily shared with their employer or on social media platforms such as like LinkedIn.

If you build it, they will come

One of the biggest challenges in rolling out the initiative was convincing industry participants that the Virtual Classroom isn’t meant to replace all-important, in-person educational events—in fact, it’s actually meant to complement them. The team’s research ultimately found that participants appreciated having the option for both in-person and virtual sources for education, which they perceived as a much more modern approach to meet the needs of those interested in learning about the aerosol industry.

The Virtual Classroom launched with a range of beginner level “101” courses, covering topics such as Containers, Propellants, Caps, Actuators, Valves and Recycling. All content was created by trusted industry leaders such as Montebello Packaging, Aeropres Corp., Diversified CPC International, The Chemours Co., LINDAL Group, eStyle Caps & Closures, Silgan Dispensing Systems, Honeywell, Rackow Polymers, the Household & Commercial Products Association (HCPA) and Aptar Beauty + Home.

Future learning

This launch is just the beginning. We look forward to adding more advanced courses, covering additional topics and areas of interest, as well as expanding offerings to include other resources such as industry profiles, trend information and live webinars. We are also excited to tap the growing base of enrolled learners to find out what they want to learn about and to make sure that that content is offered. SPRAY

What is your confidence level, as a consumer, in the recyclability of the products and materials you have to dispose of? Some consumer goods are easy. Everyone knows what to do with an empty beer can or the cardboard packaging from an online delivery. However, what about an empty milk container (and with or without the cap)? What about plastic food packaging? Can a pizza box with grease be recycled or should it be thrown away? What about bubble wrap or packing peanuts?

The recycling system in the U.S. was designed to be easy for consumers to use. There’s curbside recycling, where one puts recyclables in a bin—either single-source or sorted—and places them on the curb to be picked up. Or one can take recyclables to a drop-off site, which isn’t as convenient as curbside, but is still doable. Why is there still confusion about what should—and should not—be recycled?i

Part of the challenge is that recycling systems across the U.S. are different—there is no consistency between States, or even neighboring towns, on what can be recycled and how to do it. If a consumer recycles a material incorrectly, it can contaminate the recycling stream. However, throwing everything away is wasteful and thwarts opportunities to decrease our environmental impact.

Can you imagine if our traffic signs weren’t standardized? Just think of the confusion and chaos as drivers tried to navigate the meaning of different shapes and colors between States instead of the universally-accepted red octagon for STOP.

You may be wondering why there isn’t a standardized recycling system in the U.S. Our recycling system is complex and ever-changing, so it’s no wonder that consumers are confused.

Another issue is that not all recycling programs can recycle the same materials. The U.S. has not invested the necessary resources in our waste management system, opting to ship our waste to China and other countries instead. However, with China’s National Swordii and other countries no longer accepting U.S. wasteiii, recyclable material doesn’t have as many places to go. The recycling market has been slow to respond to this challenge and government has been working to react.

One way government has responded is through the U.S. Environmental Protection Agency (EPA) and its National Recycling Strategy and Framework for Advancing the U.S. Recycling Streamiv. Congress has also been working on the RECYCLE Act,v which would direct the EPA to establish a program to award grants to improve the effectiveness of residential and community recycling programs and could be included in an overall infrastructure bill. A Federal approach that creates consistency across the U.S., while allowing for ongoing innovation, would certainly be a welcome improvement.

However, Federal legislation often takes time to establish and States have been moving more quickly to address their recycling problems. Mainevi and Oregonvii recently passed Extended Producer Responsibility (EPR) laws that will require brand owners of consumer products to join stewardship organization(s) and pay fees to support the improvement of recycling programs. Additionally, Washington State passed a lawviii to require post-consumer recycled content in plastic packaging. Multiple States have formed internal commissions to improve recycling systems within their respective States. While these actions have good intentions, they still leave us with a patchwork of requirements between the States and don’t simplify recycling for consumers.

As an avid reader of SPRAY, you might be wondering where aerosol products fit into this conversation about recycling. After all, aerosol products are primarily housed in steel or aluminum containers—metals that are inherently recyclable.

I wrote an articleix with Scott Breen from the Can Manufacturers Institute (CMI) about what we learned from our recent aerosol recycling project. That information helped us develop potential projects for the entire aerosol industry to encourage and enhance the recycling of aerosol containers, which includes improving consumer awareness of recycling, addressing critical data gaps and increasing the acceptance of empty aerosol containers by material recovery facilities (MRFs).

Here are some projects we would like to accomplish in 2022:

• Develop a methodology to determine the baseline recycling rate

• Determine the baseline recycling rate for the U.S. & California

• Develop data to determine whether aerosol containers entering the recycling stream are empty

• Investigate the economic and environmental impact of recycling aerosol containers

• Engage with MRFs to encourage acceptance of empty aerosol containers

• Engage with environmental non-governmental organizations (NGOs) to encourage municipalities to accept aerosol containers in their recycling programs.

• Develop guidelines for the industry to use to communicate with key stakeholders about how to recycle empty aerosol containers.

If all of this sounds incredibly ambitious, that’s because it is (and should be). The aerosol industry needs to be part of overall recycling discussions to ensure aerosol containers are included in mainstream recycling programs. Otherwise, consumers won’t know which metal containers can be recycled and those valuable materials will be lost to a landfill.

These aerosol recycling initiatives are open to anyone who would like to participate. You don’t need to be an HCPA or CMI member. The entire aerosol industry needs to work together on this; otherwise, consumers will remain confused and we’ll miss a great opportunity to build a more circular economy. For more information, please contact me at ngeorges@thehcpa.org. SPRAY

i Morgan, Blake. Why Is It So Hard To Recycle? Forbes. April 21, 2021. Available here

ii Katz, Cheryl. Piling Up: How China’s Ban on Importing Waste Has Stalled Global Recycling. Yale Environment 360. March 7, 2019. Available here.

iii link

iv link

v link

vi Available here

vii Available here

viii Available here

ix link