Written on: September 1, 2012 by SprayTM

The Thai Aerosol Association (TAA) released figures for aerosol production

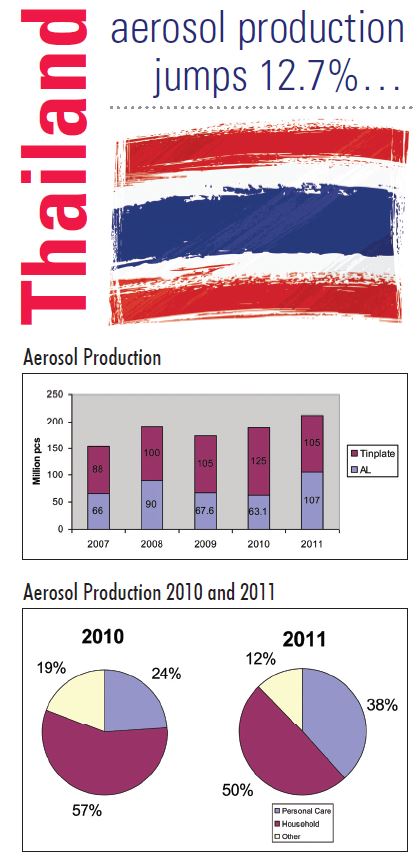

in Thailand for 2011. Overall, production was up a healthy 12.7% from 2010, with Household Products taking the lion’s share (50%). Personal Care Products now comprise 38% of all production, up from 24% in 2010. Other Products decreased to 12% in 2011 from 19% in 2010.

The use of aluminum jumped considerably from last year, from just over 63 million pieces to 107 million pieces in 2011. Tinplate steel cans declined, however, down from 125 million pieces in 2010 to 105 million pieces in 2011.

Air care in Thailand

According to research company CompaniesandMarkets.com, the Thai Air Care market increased by 10% in 2010 to reach Bt2.6 billion ($190,657,773).

Aerosol and spray air fresheners dominated the Air Care sector in Thailand and new product launches helped to boost growth. The value and growth rate of standard spray/aerosol air fresheners far exceeded concentrated spray/aerosol air fresheners in 2010, thanks to affordable prices and large

customer base, whereas concentrated spray/aerosol air fresheners had a much higher unit price. Also, new innovations were seen in both categories, fuelling and maintaining their popularity.

SC Johnson & Son led the Air Care market in Thailand with a share of 43%, due to strong brand loyalty to Glade. The company also introduced a series of new products, including Glade Sense & Spray in car air fresheners, Glade Axy in gel air fresheners, Glade Sport Collections in car air fresheners and Glade Clean Air 3-in-1, as well as a non-chemical spray product.

Siam Poolsub Interchemical ranked second, accounting for a share of 17% and ARS Chemical, with its Daily Fresh brand, had a value share of 13%.

However, despite the fact that there were many factors supporting growth, sales were hindered by a decelerating growth rate in many categories. Car air fresheners in particular showed a decline of three percentage points, although it still retained a doubledigit growth rate. The category remained

competitive, and this may have contributed to holding back growth and presenting a more sluggish rate in 2010.

A slowdown in the growth rate over the forecast period is expected because the consumer base is limited to consumers in urban areas. Spray/aerosol Air Care products in particular are not considered to be necessary for consumers in rural areas, as they have fresher air, according to